Management

Biden administration to roll back the Betsy DeVos Title IX rules

New Education Department regulations would undo Trump administration changes to sexual discrimination policies at U.S. colleges and universities, now requiring the schools to have in place measures to offer support to students and employees alleging discrimination.

Pay & Benefits

OPM has new tools to fight improper health insurance enrollments

Watchdog agencies and Congress have previously chided the federal government’s HR agency for the lack of internal controls ensuring that family members of federal workers and retirees remain eligible for the federal workforce’s health insurance program.

Pay & Benefits

Justice Department outlines benefits rule for Havana syndrome victims

A new interim final rule details how the department would compensate employees and dependents with qualifying brain injuries from anomalous health incidents.

Tech

TSA looks to AI to enhance x-ray screenings of travelers’ luggage

The Transportation Security Administration is already using facial recognition to verify the identity of travelers but wants to improve its scanners to detect more prohibited items.

Sponsor Content

Modernizing public health care

Discover how Optum Serve helped leading federal agencies address systemic problems and improve community health and well-being efficiently, effectively and sustainably.

Workforce

Pekoske touts impact of pay increases at TSA budget hearing

Workforce attrition has halved since the implementation of a new pay system that mirrors the General Schedule, while employee morale has reached its highest ever, according to the annual Federal Employee Viewpoint Survey.

Pay & Benefits

Postponing retirement problems: Part 1

It’s important to know the difference between a postponed retirement and a deferred retirement.

Workforce

New bill would create federal grant program for digital upskilling

The proposed Digital Skills for Today’s Workforce Act would add digital skills training to grant programs that provide education and professional development services in an effort to boost the talent pipeline.

Sponsor Content

Navigating the AI revolution: Strategies for ethical implementation in federal civilian agencies

An industry expert offers an insightful demystification of AI, delving into core principles and best practices the company infuses into service, as well as advice for an ever-changing future.

Oversight

Senate rejects impeachment articles against DHS Secretary Mayorkas

In a 51-49 vote along party lines, Senate Democrats dismissed impeachment charges Wednesday against Homeland Security Secretary Alejandro Mayorkas for not meeting the threshold of high crimes and misdemeanors.

FEATURED INSIGHTS

Oversight

When -- and how often -- are SBA staffers going into the office? A senator wants the agency's IG to find out

Sen. Joni Ernst, R-Iowa, continued her criticism of federal agencies’ use of telework, calling for the Small Business Administration’s inspector general to investigate its office utilization rates after its administrator disputed the GAO’s findings.

Management

Biden’s FLRA nominees move closer to Senate confirmation

Senators appeared poised Wednesday to advance the nominations of aspiring leaders in labor-relations.

Tech

NIST adds 5 new members to its AI Safety Institute

The new members will focus on AI objectives related to national security, standards development and more.

TSP TICKER

FUND

G

F

C

S

I

APR 18 CLOSE

$18.1904

$18.6185

$78.4510

$76.1152

$40.6697

DAILY CHANGE

0.0022

-0.0567

-0.1686

-0.1516

0.0082

THIS MONTH (%)

0.21

-2.42

-4.57

-7.66

-4.47

FUND

L 2060

L 2050

L 2040

L 2030

L INCOME

APR 18 CLOSE

$15.5792

$31.3531

$52.3741

$46.2075

$25.2816

DAILY CHANGE

-0.0203

-0.0399

-0.0589

-0.0425

-0.0107

THIS MONTH (%)

-4.92

-4.22

-3.70

-3.06

-1.28

FUND

APR 18

CLOSE

CLOSE

DAILY

CHANGE

CHANGE

THIS

MONTH

MONTH

G

$18.1904

0.0022

0.21

F

$18.6185

-0.0567

-2.42

C

$78.4510

-0.1686

-4.57

S

$76.1152

-0.1516

-7.66

I

$40.6697

0.0082

-4.47

L 2050

$31.3531

-0.0399

-4.22

L 2040

$52.3741

-0.0589

-3.70

L 2030

$46.2075

-0.0425

-3.06

L 2020

$None

None

L INCOME

$25.2816

-0.0107

-1.28

Pay & Benefits

Estate planning for federal employees: Maximize benefits and minimize taxes

Make sure to review and update your estate plan regularly to reflect changes in your financial situation and personal circumstances.

Tech

Feds move to make gov websites more accessible to people with disabilities

It’s the first time the federal government has ever issued rules clarifying how the more than 30-year-old Americans with Disabilities Act applies online. But the new rules come with a hefty price tag for state and local governments.

Management

Texas Republicans urge Senate Democrats to give the DHS secretary a full impeachment trial

The House voted to impeach Alejandro Mayorkas on Feb. 13 over charges of refusing to enforce the law and “breach of public trust.”

Tech

100,000 have used IRS Direct File to submit their tax returns

The agency has not yet determined whether the pilot program for the tool will be extended into a permanent offering.

Management

OPM Director will leave the Biden administration

Kiran Ahuja oversaw efforts to transform the federal government’s HR agency into a government-wide leader on human capital policy, issuing new policies governing interns, telework and civil service protections.

Pay & Benefits

VA is trimming its PACT Act claims backlog, but enrollees may be on the ‘low side’

Veterans Affairs Secretary Denis McDonough says that the department is quickly processing new claims made by veterans exposed to toxic substances during their military service, thanks, in part, to robust hiring, but warns that those claims may not have hit their peak yet.

Pay & Benefits

Bill wants to solve the coverage gap for National Guard and reservists by extending VA eligibility

Legislation from Rep. Joe Neguse, D-Colo., proposes to expand VA health care benefits to personnel in the reserve components when not on active duty to help ensure “force readiness.”

Workforce

Biden rescinds COVID-era executive orders, folding safer federal workforce task force

The Office of Personnel Management issued new guidance last week rescinding some forms of COVID-19-related administrative leave, but preserving four hours of paid leave for federal employees to get vaccine booster shots.

Management

Senate Republicans push for Mayorkas impeachment trial

Democrats say the charges are based on policy disputes rather than the “high crimes and misdemeanors” threshold of an impeachable offense.

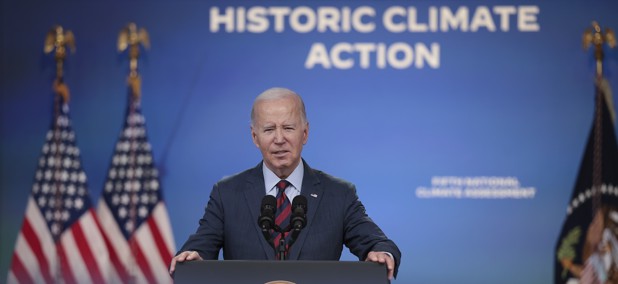

Management

Biden’s environmental justice scorecard offers more questions than answers

The White House's own environmental justice progress report gives little insight into the green benefits delivered to disadvantaged communities.

Oversight

HHS removed Login from its grantee payment system after funding theft

Hackers used data from a federal contracting hub to steal funding from seven grantee organizations in an HHS breach that occurred last year. Both HHS and GSA say that Login.gov was not compromised or connected to the theft.

Management