Pay & Benefits

OPM reminds agencies of pay provisions in 2024 NDAA

The most recent iteration of the annual defense policy bill extends a number of temporary pay and benefits provisions for both civilian and military service members and allows veteran feds to credit active duty service toward paid parental leave requirements.

Tech

Bipartisan bill seeks to grow NASA program using drones to fight wildfires

New legislation attempts to improve NASA’s Advanced Capabilities for Emergency Response to Operations program so firefighters can more effectively use drones.

Management

OPM guidance details when agencies can ask about applicants' criminal history

Though the federal government had already implemented a form of “ban the box” administratively, the Fair Chance to Compete for Jobs Act necessitated an update of the policy.

Pay & Benefits

Postponing retirement problems: Part 2

Federal law trumps what might seem to make the most sense.

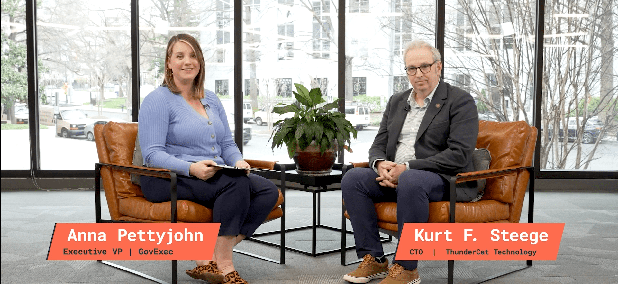

Sponsor Content

GovExec TV: Five Questions with Kurt Steege

Workforce

Under-resourced FEMA would see new commitment to growing workforce under bipartisan bill

The agency has struggled to keep pace with new and increased demands.

Management

House panel advances bill to make federal contracting easier to understand

The Plain Language in Contracting Act would require agencies to use easy-to-understand language for certain procurement notices pertaining to small businesses.

Management

Senators call on postal board to abandon DeJoy’s USPS reforms

The overhaul is harming the Postal Service, Democrats say, though postal leadership says it just needs more time.

Sponsor Content

Innovate with Lumen for public administration agencies

Take advantage of the full range of capabilities needed for success in a digital-first business landscape, delivered in a simple platform approach.

Oversight

New bill would establish an IG for the Supreme Court

The Judicial Ethics Enforcement Act calls for a new inspector general’s office to investigate alleged misconduct and prevent waste, fraud and abuse across the judicial branch.

FEATURED INSIGHTS

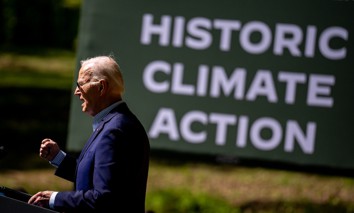

Workforce

Can Biden’s new jobs program to fight climate change attract women and people of color?

The American Climate Corps program aims to recruit a diverse workforce. But it will face challenges including low pay, the need for child care, and historic discrimination against women in the trades.

Management

Bipartisan group looks to push IRS towards simpler math error notices

The IRS MATH Act would require the tax agency to send more specific, straightforward notices when it corrects simple math errors on tax returns.

Pay & Benefits

Are High Deductible Health Plans the right FEHB plan for you?

For most federal employees, HDHPs will be the cheapest FEHB plan type. Here’s how they work.

TSP TICKER

FUND

G

F

C

S

I

APR 26 CLOSE

$18.2074

$18.6272

$79.8499

$78.2895

$41.4755

DAILY CHANGE

0.0021

0.0495

0.8078

0.6078

0.2070

THIS MONTH (%)

0.31

-2.37

-2.87

-5.02

-2.58

FUND

L 2060

L 2050

L 2040

L 2030

L INCOME

APR 26 CLOSE

$15.8877

$31.8699

$53.1369

$46.7780

$25.4284

DAILY CHANGE

0.1262

0.2154

0.3172

0.2349

0.0585

THIS MONTH (%)

-3.04

-2.64

-2.29

-1.87

-0.70

FUND

APR 26

CLOSE

CLOSE

DAILY

CHANGE

CHANGE

THIS

MONTH

MONTH

G

$18.2074

0.0021

0.31

F

$18.6272

0.0495

-2.37

C

$79.8499

0.8078

-2.87

S

$78.2895

0.6078

-5.02

I

$41.4755

0.2070

-2.58

L 2050

$31.8699

0.2154

-2.64

L 2040

$53.1369

0.3172

-2.29

L 2030

$46.7780

0.2349

-1.87

L 2020

$None

None

L INCOME

$25.4284

0.0585

-0.70

Workforce

VA employee discipline back in the spotlight as lawmakers move new bills

Another measure would provide VA managers with more training on disciplining employees.

Pay & Benefits

Congressional Dems urge OPM to fully cover IVF in feds’ insurance program

More than 175 Democratic lawmakers said the federal government must do more to protect access to health services like in-vitro fertilization in light of a recent Alabama court ruling that effectively banned the procedure alongside abortion services.

Tech

Federal CIO defends Login security after health agency dropped it from grantee system

Clare Martorana doubled down on Login’s capabilities, saying the government “needs to continue to rely” on the tool.

Management

New rule cements sustainability mandate for federal buyers

A new update to the Federal Acquisition Regulation is meant to help the government meet goals for net-zero procurement by 2050.

Management

Biden signs extension of controversial spying program into 2026

The Section 702 authorities were reauthorized without the addition of a warrant requirement to review the communications of Americans caught up in foreign surveillance.

Workforce

State, Defense departments announce deal to expand military spouse access to remote work jobs

The move to allow federal employees to telework while overseas with their service member spouses is part of a larger effort to boost recruitment of military spouses.

Workforce

Biden announces first tranche of Climate Corps jobs with hopes of segueing thousands into federal service

Participants can leverage their experience into federal internships and jobs.

Management

GSA lacks management controls for keeping foreign gifts, IG says

An inspector general’s audit of the agency’s Foreign Gifts and Decorations Program found that GSA officials were missing gifts from its inventory while also possessing prohibited items due to insufficient management practices.

Management

FEMA is making an example of this Florida boomtown. Locals call it ‘revenge politics’

The Biden administration is trying to punish Lee County for rebuilding flood-prone homes. The state’s Republican politicians are fighting back.

Management

Senate Veterans’ Affairs chair calls for more mental health care providers in rural areas

Sen. Jon Tester, D-Mont., asked VA Secretary Denis McDonough to increase the number of providers and ensure they are “in locations where veterans need them most.”

Management

BLM to finalize rule allowing federal leases targeted at protection of natural areas

The rule marks a shift in the agency’s focus toward conservation.

Management